Dyme’s economic model pioneers democratic blockchain adoption using the best thinking in econometric research.

Earlier this year, we publicly shared our excitement with you and announced Dyme to the world.

Dyme’s platform is an environmentally friendly, cost-efficient, high-throughput, low-latency permissionless blockchain. Dyme is part of the Cosmos Interchain, built on Ignite and using Cosmos SDK. We believe Dyme expands on the Cosmos “Internet of Blockchains” positively. It provides economic models and exemplars of use for Web 3 projects. It further offers a reserve cryptocurrency for those projects to use.

Today, we share the design of Dyme’s economics and incentives – also known as Dyme’s tokenomics. This complements the design we recently shared about Dyme’s token allocation.

The Components of the Dyme Economy

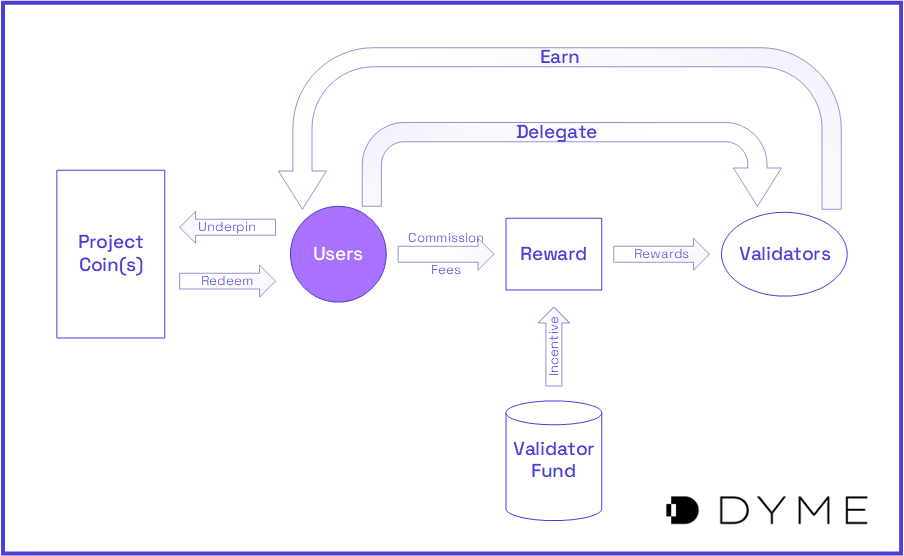

The Dyme economy has five core components:

- The DYME token is the Dyme network’s native asset.

- Charged on all network operations, commission fees reward participants of the proof-of-stake mechanism and prevent spam and denial-of-service attacks.

- Dyme’s validator fund shifts rewards across time and compensates validators for early adoption of Dyme.

- The Dyme proof-of-stake mechanism selects and rewards honest behavior by the Dyme platform’s validators and incentivizes against dishonest behavior.

- Dyme’s core economic structures allow for the creation through underpinning through escrow and redemption through the burning of project coins.

The governance mechanism that supports a democratic organization is separate from the economics and incentives (the tokenomics) of Dyme. Dyme’s novel on-chain voting module facilitates governance and protocol updates.

This article will describe each element of the five components in further detail. Throughout, we use the visual representation in the following figure to aid the discussion:

1. The DYME Token

As Dyme’s token allocation paper described, the total supply of Dyme is 50,000,000,000 (i.e., fifty billion) DYME. A share of Dyme’s total supply will be liquid at mainnet launch, with the remaining tokens vesting over the coming years or distributed as future validator reward subsidies, termed the “validator fund” in this document. Each DYME token is divisible up to many decimal places.

NOTE that Dyme refers to the DAO or the legal entity when capitalized as a proper name. When fully capitalized, DYME refers to the cryptocurrency. Dyme’s native asset is DYME.

Whether used for staking, paying commission fees, as a source of native on-chain liquidity, as an underpinning for a Web 3 project token, or as a claim on future governance, the DYME token enables a distributed and decentralized network like Dyme to flourish and grow.

Dyme’s novel on-chain voting module allows for governance and protocol updates. Both currency and governance token functions are coresident in DYME. We believe this aligns with the economic and governance incentives of the community of Dyme holders, which we call Dymeians.

2. Dyme’s commission fees

Dyme’s economic design includes an efficient and sustainable economic mechanism for funding calculation and storage of transactions. The commission fees are akin to Ethereum’s gas pricing mechanism in that the commission achieves three essential outcomes:

- The commission mechanism delivers users a predictable, transparent, and low-fee structure for network usage.

- Validators are provided an incentive to optimize their transaction processing operations.

- Network operators and participants are incentivized to prevent spam and denial of service attacks and not to disrupt the network.

Dyme’s commission fees are intended to deliver an optimal user experience to Dyme users, who can focus on using the Dyme Protocol without worrying about forecasting the current or future price of gas fees. Validators are encouraged through design and software code to engage in market pricing so that commission fees are maintained optimally. This laissez-faire philosophy permits free-market pricing without centralized intervention.

Dyme believes this model of pricing encourages innovation and self-responsibility among network participants. Dyme further holds that it will promote competition and free markets as the usage of Dyme grows.

Adverse outcomes are muted through the staking mechanism, which rewards the action of good actors when bad actors attempt an exploit or other nefarious activity. As the stake of the bad actor is forfeited to the consensus of good actors, it is simultaneously an incentive against poor behavior and for consistently good behavior.

3. Dyme’s validator fund

The allocation for validators is colloquially termed “Dyme’s validator fund” or “Dyme’s Validator Incentive Mechanism.” The purpose of the validator fund is to compensate network operators (e.g., validators) for early adoption of Dyme. The fund programmatically shifts rewards across time to achieve this purpose.

The purpose of the validator fund is to serve as an incentive to adopt Dyme before Dyme’s commission fees are self-sufficient to effectively attract and retain validators. While no crystal ball exists for the future, other successful blockchains have taken five to nine years to achieve self-sufficiency. Based on these prior projects and a healthy dose of pessimism, Dyme chose a roughly 16-year distribution model.

The size of the fund is determined by the token allocation referenced above. The initial spending method is set in Dyme’s genesis.json file. The initial “inflation rate” is set at 8.3477% and is iteratively reduced by half on a roughly annual basis.

The Dyme blockchain will launch with a theoretical maximum block creation rate of 4,855,015 blocks per year. To the best of our understanding, this is consistent with other Interchain projects. From this, it can be inferred that the initial per-block reward will be roughly 730.74 DYME. This decay rate and maximum block creation rate can be changed as a function of governance. It is helpful to note that while the maximum block creation rate can be changed, the actual validation process produces the “real” block creation rate. This impacts the lifecycle of the validator fund.

4. The Dyme proof-of-stake mechanism

The Dyme platform is part of the Interchain. Dyme uses the open-source Tendermint Core byzantine fault-tolerant state machine replication engine, commonly shortened to “Tendermint blockchain.”

Dyme also uses the Cosmos SDK (or Software Development Kit) as we build a blockchain with higher computation power than Ethereum and custom logic specific to the objectives of Dyme. Enabling these increases in computational power and allowing for custom logic are core objectives of Cosmos SDK; Dyme leverages these open-source software tools to provide Dyme with the broadest possible reach.

CometBFT, Ignite CLI, Tendermint Core, Cosmos

For the sake of clarity, CometBFT is “a fork of, and a successor to, Tendermint Core,” according to the Interchain Foundation. Tendermint changed its name to Ignite, and Tendermint Core was rebranded Ignite CLI. Thus, Ignite CLI and CometBFT are both successors to Tendermint Core.

While published reports of a messy breakup of Cosmos’ founding team in 2020 raised concerns about direction and momentum at that time, the writers have found no such news about this current split. We generally view this as a positive since an “Internet of blockchains” requires more than one type of server to make the concept of interoperability genuine.

To that end, Dyme uses the IBC (Inter-Blockchain Communication) protocol aligned with Cosmos SDK and Tendermint to provide seamless interoperability between heterogeneous blockchains. Dyme views this as an optimal resource for bridging in that it uses code developed and improved by a community more than just Dyme.

Associated with the Dyme proof-of-stake mechanism is Dyme’s novel governance module. Protocol upgrades and Dyme Foundation governance are passed through on-chain voting proposals. The DYME token is helpful because it allows holders to participate in governance. The process is centered around a “one wallet, one vote” model that more closely resembles a democracy than the typical oligarchical “one vote per token” model. This will be described more thoroughly in a discrete document.

5. Dyme’s core economic structures

Dyme’s core purpose is to serve as a reserve currency for digital and Web3 projects. To facilitate that, several core economic structures were designed that have been embedded in the code of the Dyme blockchain.

First among these economic structures is the minting of a Project Coin (PC) through the escrow of DYME and various permutations. These PCs need to be fungible with non-collateralized PCs minted as part of the governance decisions of the project.

For this discussion, it is presumed that the project uses a blockchain and IBC, which connects it to Dyme, and that Dyme is aware of this connection.

Case 1: Minting of PC through escrow of DYME.

Any DYME holder may mint a Project Coin. To do so, the DYME holder provides an amount of DYME to escrow and Project Coin wallet address to receive the minted PC. The DYME are escrowed in this Smart Contract, and an Oracle should be established by the project to provide a “minting ratio” such that

Mproj = Edyme x Omint

Where Mproj is the amount of PC minted, Edyme is the amount of DYME to be escrowed, and Omint is the minting ratio obtained by the Oracle, shown as a percentage. Absent an Oracle response, a minting ratio of 100% will be used.

Thus, if a minting ratio of 200% is established and a DYME holder mints PCs using 100 DYME, they will receive 200 PCs in the project wallet they specify.

- Escrow/Mint process:

- Available to any DYME holder,

- Fungible with PC minted in SC2,

- Dyme blockchain locks the DYME tokens and relays proof to the project blockchain,

- Project blockchain mints its own representative tokens (PC) in the form of voucher replacement tokens; and

- Places PC in project blockchain wallet ID specified in the contract.

Case 2: Escrow of DYME without contemporaneous minting of PC.

In this case, the project escrows DYME but does not mint the PC. This is used so that the project can bolster the total escrowed DYME when it sells PCs inside its’ app or using various other methods.

Example: The project offers 10,000 PCs for $100.00 plus tax through an Apple in-app purchase. This translates to $0.01 per PC. Apple approves the transaction, and the project mints on the project’s blockchain or otherwise transfers 10,000 PCs to the User’s account. After Apple extracts its 30% fee, they deliver the project $70.00 two days later. The project accounts for their business expenses in providing the in-app purchase and chooses to escrow $35.00 in DYME for their PC. The project buys $35 in DYME and escrows it. Since the project has already settled the PC side of the transaction with their User, there is no need to mint PCs.

NOTE that there is an obvious benefit to the project in rolling up transactions. Projects are not required to couple DYME purchases with every PC purchase on their project blockchain.

Also, NOTE that Dyme does not mandate this process. Central to Dyme’s thesis is that a project should set its course for underpinning its’ project coin with DYME. Various reasons exist for different behaviors, though the one described above helps to illustrate the reasoning behind the economic structure.

Case 3: Release by certain authorized Project Users of DYME through burning of PC.

For those PC Users authorized by a project to do so, they may redeem PCs for DYME using these structures according to the formula

Drel = (Pred / Ptot) x Desc

Where Drel is the amount of DYME released to the specified DYME wallet, Pred is the amount of PC burned as part of the redemption process, Ptot is the total supply of PC outstanding, and Desc is the total DYME in escrow.

- Burn process:

- Project Blockchain sends PC voucher tokens to Dyme blockchain,

- The project blockchain burns (destroys) the voucher tokens,

- The Dyme blockchain unlocks (releases) the locked tokens; and

- Places DYME in Dyme blockchain wallet ID specified in this structure.

This case is interesting because it originates on the project’s blockchain. This implies that the project determines under what conditions users can swap PCs for DYME. This does not preclude other forms of swapping; instead, it provides a walled garden framework for projects seeking to quickly adopt a cryptocurrency while maintaining their project currency and the implicit financial and governance controls.

Dyme must comply with various laws and regulations. Among these are anti-money laundering (AML) and countering the funding of terrorism (CFT) rules. To that end, Dyme maintains a Customer Identification Program, a Customer Due Diligence program, and performs ongoing monitoring.

Dyme expects a more complex onboarding for the DYME wallet than the project wallet since DYME is a permissionless public blockchain.

Closing

As designed, Dyme’s economic model operates smoothly in sync with Dyme’s code. Of significant note, Dyme’s validator fund and commission mechanisms work hand-in-glove to promote honest actions and inhibit malicious activities. Dyme’s governance further amplifies this by embracing democratic voting rather than oligarchical supervision.

The ultimate goal is to serve Web3’s growing projects and their next billion users.