DeFi is an emerging financial system that provides new forms of value and utility not present in conventional financial systems. A subcategory within the broader crypto space, DeFi offers many of the services of traditional financial institutions in a fashion controlled by the masses instead of a central entity or entities.

The “broader crypto space” is Web3. In 2014, Ethereum’s Gavin Wood wrote a foundational blog post in which he sketched out his view of the new era. Wood called Web3 a “reimagination of the sorts of things we already use the web for, but with a fundamentally different model for the interactions between parties.”

Wood continued: “Information that we assume to be public, we publish. Information that we assume to be agreed, we place on a consensus-ledger. Information that we assume to be private, we keep secret and never reveal.” To realize this vision, all communication is encrypted, and identities are hidden. “In short, we engineer the system to mathematically enforce our prior assumptions, since no government or organization can reasonably be trusted.”

In this Dyme Piece, we’ll look at the world of decentralized finance, the decentralized crypto exchanges that support DeFi platforms, some examples of DeFi applications, and the smart contracts at the base of all decentralized finance, all to answer the question “what is DeFi?”

Centralized Finance vs. Decentralized Finance (DeFi)

Oligarchy versus democracy

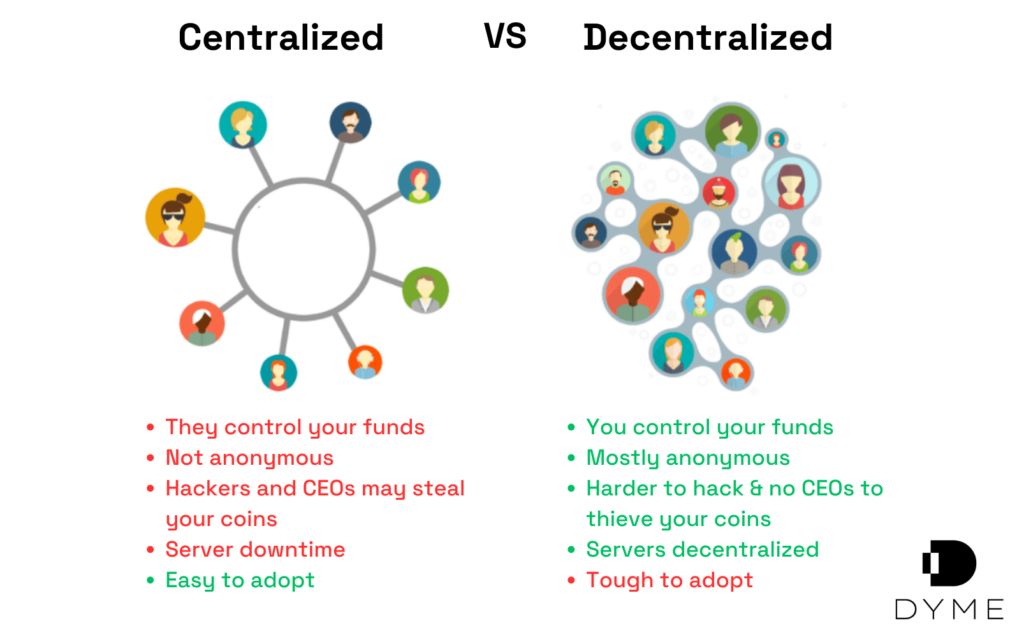

Finance is easy to understand, but what is decentralization? In short, decentralization means that no chief body controls something. Decentralization proponents will couch the difference as “oligarchy versus democracy.” To an extent, that’s true. While centralized financial institutions are, well, centralized, more than a few companies claiming to be decentralized were (or are) run by a small group of insiders.

That’s the very definition of an oligarchy. This means the difference might be guaranteed oligarchy in the case of centralized financial institutions versus the potential for democratic rule with decentralized finance.

One simple rule: the more smart contract language you can see and the more complete the smart contracts are, the greater the chance you’ve found a truly decentralized finance organization.

Corporate versus, well, corporate

Banks and other financial institutions have power over your funds. These entities can freeze your assets, and you are at the mercy of their hours of operation and cash reserves. In some countries, central authorities work to protect consumer banking; in others, there’s much less concern about protection and access to banking.

With apologies to blockchain purists, decentralized finance does not transcend the reach of central authorities. Smart contracts do not transcend the reach of courts, and they are certainly bound to the rule of law.

Similarly, defi applications likely have some corporate structure to connect them to jurisdiction in the real world. This allows defi protocols to manage financial transactions associated with traditional finance. It also allows the peer-to-peer transactions expected on a defi platform.

There is certainly some bleed-over from the rapaciously profit-driven nature of traditional financial institutions to the defi platforms and defi protocols. An examination of the failings which led to the Crypto Winter of 2022 might find a strong alignment between a lack of decentralization and the risk of fraud. Or, at the least, poor outcomes.

This gives rise to a third term: CeFi. While it stands for centralized finance, it focuses on crypto assets and centralized exchanges. Both CeFi and Defi applications use smart contracts and distributed ledger technology as their core financial technology. This separates them from centralized financial institutions.

How did DeFi platforms start?

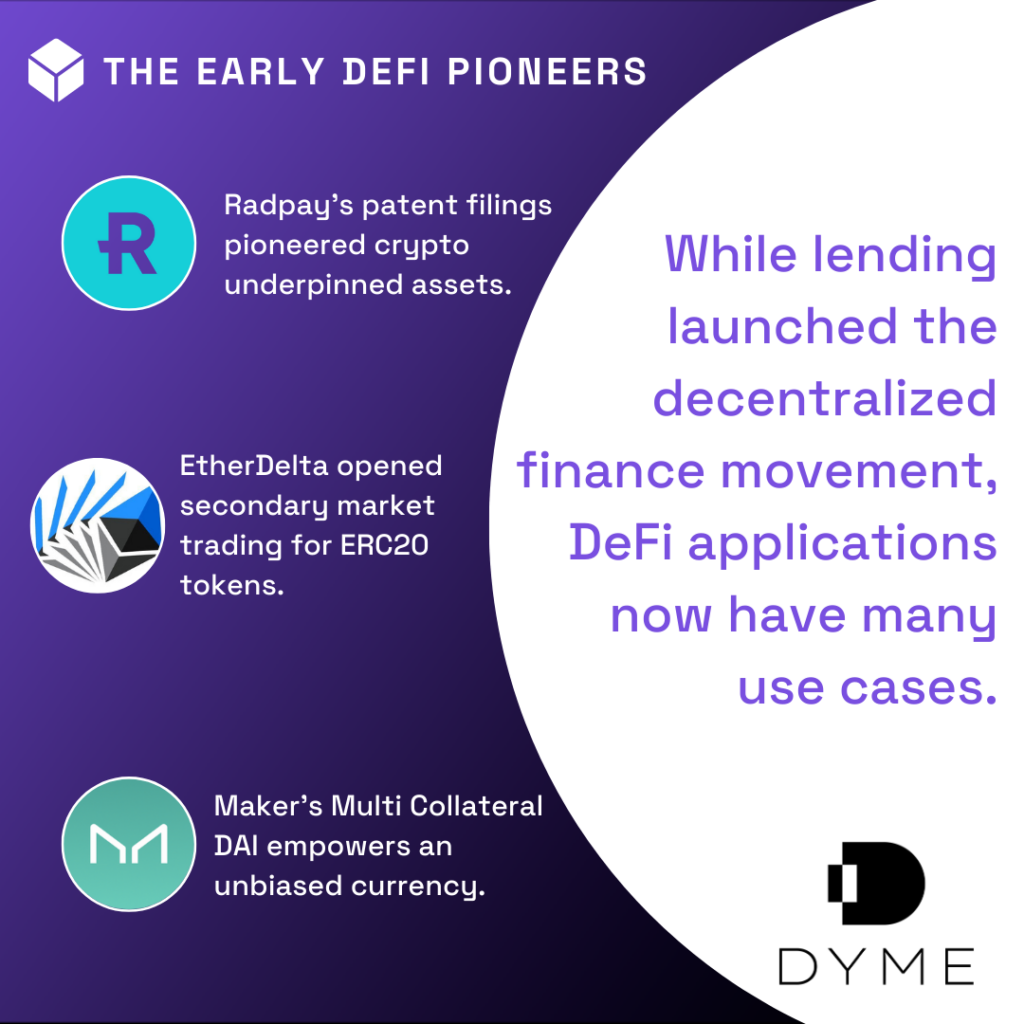

The early pioneers: Maker, Radpay, and EtherDelta

DeFi’s earliest pioneers were Maker and EtherDelta in 2017, Radpay in 2018, and the Multi Collateral DAI in Maker in 2019. Of those first projects, Maker remains an important project in DeFi. In each case, the project created a programmatic means to escrow one cryptocurrency and access a different cryptocurrency. This makes Radpay, Maker, and EtherDelta all lending platforms.

While lending launched the DeFi movement, decentralized finance applications now have many use cases. DeFi participants have access to savings accounts, credit cards, and yield farming accounts. They can lend money to earn interest, borrow money, provision flash loans, and more. Decentralized finance’s ultimate goal is to challenge and eventually replace the local bank. It also seeks to replace the global financial institution you use for your current financial products.

Traditional financial services providers build closed systems with limited access to third parties. DeFi projects often harness open-source code, allowing anyone the opportunity to build on pre-existing applications in a permissionless, composable manner.

Wen Moon?

The ICO boom in 2017 and 2018 saw market participants flood the community, eager to acquire digital currency. The “wen moon” phrase took form as seemingly everyone with an internet connection waited for their crypto holdings to skyrocket in value. During this time, DeFi products comingled with centralized systems, and more than one centralized exchange was born.

This was the birth of the poor outcomes mentioned earlier. The combination of a frothy market and an intrinsic connection to digital money made DeFi networks both a great place for innovation and a place where bad actors could act badly.

Decentralized finance DeFi applications were born in an environment of good intent. Many decentralized applications are today the building blocks of a decentralized future. Some are not.

The decentralized nature of the future of banking

So decentralized finance (defi) is an emerging financial system within Web3 that provides new forms of value and utility that aren’t present in conventional financial systems. The main difference between Web3 and DeFi is that DeFi is built on top of existing smart contract platforms, such as Ethereum, while Web3 uses smart contracts but is built on the internet itself.

Both DeFi and Web3 involve creating a future more decentralized and more secure than their centralized counterparts. They both rely on smart contract language to manage decentralization. Both require users to have an internet connection. Web3 and DeFi both use blockchain technology.

Why is decentralized finance (DeFi) important?

Decentralized applications solve market problems today

Web3 is a new paradigm for the internet. It’s based on using blockchain technology to make the internet fairer and more decentralized by giving users control of their own data, identity, and money. And since DeFi is a part of Web 3.0, the concepts, access, and technologies are very similar.

Through a peer-to-peer (P2P) network, a DeFi application eliminates intermediaries and permits decentralized banking, which wasn’t possible before due to the need to get transactions approved through third parties. The global financial crisis of 2008–09 showed that middlemen cannot be trusted as customers are frequently unaware of the underlying regulations governing financial products and services.

The goal of DeFi is to create an open, trustless, and permissionless financial market. Much of the technology in the DeFi space aims to improve the current financial system, potentially improving the user experience (for both businesses and their clients).

DeFi enables risk dispersal

The decentralization aspect of DeFi is not only a dispersal of power but can also be a dispersal of risk. For example, if a company holds all of its customer data in one spot, a hacker needs only to access that particular site for a vast amount of data. In contrast, storing that data across several locations or removing that single point of failure could improve security.

The methods of building an app using a blockchain network presume public access and thus presume cryptographic security. This makes DeFi different than traditional financial services companies, who may trust a firewall or other security methods and build an application less secure than it should be.

The evolution of trust favors DeFi apps

Consumer trust is a complex topic and when it comes to financial decisions and financial services, the complexity is at or near its height. It is well-established that financial brands suffer from mistrust and outright distrust, and yet consumers still use financial services firms.

Why?

One argument is the myth of the qualified professional. When a consumer wants to transfer capital, they trust a qualified banker. Conversely, when a tree hits a home, the homeowner is likelier to trust a qualified insurance agent over a decentralized insurance program.

But the bias toward individuals is decaying. A study from the University of Georgia showed a shift in trust toward computers and away from people. This implies that defi works for more people in more areas.

It also means that defi won’t be relegated to defi trading, liquidity mining, or defi projects only but that defi apps will grow to support most or all financial product needs in the future.

Prediction markets: decentralized finance meets fortune telling

Putting your money where your prediction is

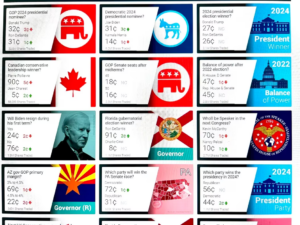

A prediction market is a type of market where participants can buy and sell contracts that represent the outcome of future events. These markets are based on the idea that the collective wisdom of a large group of people is more accurate than the prediction of any individual expert.

Participants in a prediction market can buy and sell contracts that pay out a fixed amount if a specific event occurs, such as the outcome of an election or the price of a commodity at a certain date in the future. The price of these contracts reflects the collective belief of the market participants about the likelihood of the event occurring.

Prediction markets can be used for various purposes, such as predicting the outcome of political elections, the success of a new product launch, or the likelihood of a disease outbreak. They are also used in industries such as finance and insurance to help assess risk and make informed decisions.

One of the advantages of prediction markets is that they can provide accurate and timely information about the likelihood of future events, often faster and more accurately than traditional polling or expert analysis.

They didn’t predict that outcome, did they?

One prediction market in the crypto space, PredictIt, has been ordered to shut down by the Commodity Futures Trading Board (CFTC.) PredictIt, several of its traders and academic users, and technology provider Aristotle International have filed a lawsuit seeking to block the CFTC from shutting down the popular election betting site.

“The CFTC action taken on Aug. 4, 2022, threatens to harm not only the value of modest investments of more than 80,000 PredictIt traders, but the quality of the anonymized data used by more than 200 academic researchers and university educators,” Aristotle wrote in an email to PredictIt traders. Aristotle is the contract service provider for PredictIt.

Decentralized exchanges (DEXs)

A decentralized crypto exchange (DEX) is a type of cryptocurrency exchange that operates in a decentralized manner, meaning that it is not controlled by any central organization. In a DEX, traders can exchange cryptocurrencies directly with each other without the need for an intermediary or a central order book.

In a decentralized crypto exchange, all transactions are recorded on a blockchain, which is a distributed ledger that is maintained by a network of computers. This means that the exchange is transparent, secure, and resistant to censorship and hacking attempts.

One of the main benefits of using a decentralized crypto exchange is that it offers greater privacy and security to traders since they are not required to disclose personal information or store their funds on a centralized platform. Additionally, since there is no central authority controlling the exchange, there is no risk of the controlling authority shutting down the exchange.

However, decentralized exchanges are generally less liquid than their centralized cousins, meaning that there may be fewer buyers and sellers for certain assets, which can result in wider bid-ask spreads and higher transaction fees. Additionally, DeXs are typically more complex to use than centralized exchanges, which may limit their appeal to less experienced traders.

How Does DeFi Work?

Decentralized finance runs independently of a central authority, such as a bank, and enables users to conduct financial transactions directly with one another. This includes peer-to-peer (P2P) transactions like lending, loans, and liquidity pools that are governed by smart contracts.

DeFi is an effort to combat centralized institutions, such as the government or banks, that are thought to have too much control over our data and assets. As a result, DeFi is meant to be permissionless in that it allows all users the ability to participate in the system, and transactions do not need to be authorized by an institution.

DeFi has one more inherent characteristic: transparency; it allows all transactions to be in the purview of everyone in the system.

DeFi’s ecosystem consists of the following:

A blockchain layer with smart contract capability

Layer 1 is the base network or blockchain on which DeFi tokens, protocols, apps and smart contracts are built. Examples of layer-1 networks include Ethereum, Bitcoin, Ignite (Cosmos), and Polkadot.

The smart contracts may live inside the blockchain, which is the Ignite model of modularization. They can also reside on the blockchain, which is the Ethereum model itself.

Decentralized exchanges

A decentralized exchange (DEX) is a platform where users can buy, sell and trade digital assets. They do so without the involvement of a centralized system or authorized third parties. Rather than centralized organizations, smart contracts — self-executing contracts expressed in computer code — take their place.

Aggregators and wallets

Aggregators are decentralized interfaces that let users manage assets across various yield-farming platforms to maximize profits. For instance, RocketX and 1inch are aggregators that offer access to liquidity. On RocketX, one can swap from one wallet and receive tokens on a different wallet with a single click, allowing users to navigate through both centralized and decentralized platforms.

Decentralized marketplaces

Instead of an exchange, decentralized marketplaces allow users to undertake peer-to-peer transactions with one another without the need for an intermediary.

Is Bitcoin Decentralized Finance?

Sort of.

It is certain that Bitcoin is decentralized. It is also certain that Bitcoin deals with finance. Bitcoin is to DeFi what gold is to banks. Bitcoin lacks the smart contract structure to power exchanges, and it’s daunting to build a defi project with just Bitcoin. Various defi projects have been built on top of Bitcoin to provide smart contract structures, Bitcoin itself is not “smart contract capable.” Some Bitcoin projects have smart contracts published and working on them.

Closing

We end very much where we began: DeFi is a subcategory within Web 3.0 that offers many of the services of traditional financial institutions in a fashion controlled by the masses instead of a central entity or entities. DeFi provides new forms of value and utility not present in conventional financial systems.

Web3 is broader. It’s a re-imagination of today’s Internet with a fundamentally more empowering model for interaction between parties.